oke stock dividend date

61 rows The next Oneok Inc. Predicted Next Dividend Ex.

My Top Dividend Strategy Delivered A 161 Return Here S How It Works Investing Com

There are no upcoming events for OKE.

. This trading strategy invovles purchasing a stock just before the ex-dividend date in order to collect the dividend and then selling after the stock price has recovered. Dividend was 935c and it went ex 2 months ago and it was paid 2. Nasdaq Dividend History provides straightforward stocks historical dividends data.

OKE will begin trading ex-dividend on January 24 2020. Find the latest ONEOK Inc. The previous trading days last sale of OKE was 6521 representing a -235 decrease from the 52 week.

OKEs annual dividend yield is 594. OKE stock quote history news and other vital information to help you with your stock trading and investing. Last known quarterly dividend.

OKE dividend growth history. See the dividend dates for Oneok OKE stock dividend yield Ex-dividend dates history and payout ratio. By month or year chart.

Stocks Eversource EnergyES and ONEOK IncOKE are similar in terms of market cap compared to ONEOK Inc OKE stock. Oneoks last quarterly dividend was on Jul 29 2022 ex-date with a distribution of. You already know OKE has paid 91.

This marks the 6th quarter that OKE has paid the same dividend. The previous Oneok Inc. The next dividend for OKE is projected to be 0935.

Oneok dividend history payout ratio dates. Dividend is expected to go ex in 25 days and to be paid in 1 month. Dividend payout record can be used to gauge the companys long-term performance when analyzing.

OKE s fiscal year ends in December. Shareholders who purchased OKE prior to the ex-dividend date are eligible for the cash dividend payment. OKE pays a dividend of 374 per share.

The dividend is paid every three months and the last ex-dividend date was Jul 29 2022. ONEOK OKE announced on July 20 2022 that shareholders of record as of July 29 2022 would receive a dividend of 093 per share on. Oneoks dividend is lower than the US Oil Gas Midstream industry.

Oneoks previous ex-dividend date was on Jul 29 2022. Declare date ex-div record pay frequency amount. Dividend History Summary.

84 rows In terms trailing twelve months of dividends issued OKE has returned 1634928000 US dollars -- more than 9122 of public US dividend stocks. As for stocks whose price is. TD Ameritrade displays two types of stock earnings numbers which are calculated differently.

Oneoks next ex-dividend date is projected to be between 28-Oct - 1-Nov. Be the first to know when OKE increases or cuts their dividend. A cash dividend payment of 0935 per share is scheduled to be paid on February 14 2020.

At the current stock price of 6521 the dividend yield is 574. Last dividend payment dateMay 16 2022 Last ex-dividend dateApr 29 2022. Oneok shareholders who own OKE stock before this date received Oneoks last dividend payment of 094 per share.

ONEOK has a dividend yield of 664 and paid 374 per share in the past year.

Dividend Stocks 9 High Yield Stocks With Little Risk Of A Dividend Cut Investorplace

Oneok S Oke 91 Dividends From 2000 2022 History

Five High Income Commodities Investments To Purchase To Protect Against Putin Inflation Dividendinvestor Com

What Is An Ex Dividend Date 2022 Robinhood

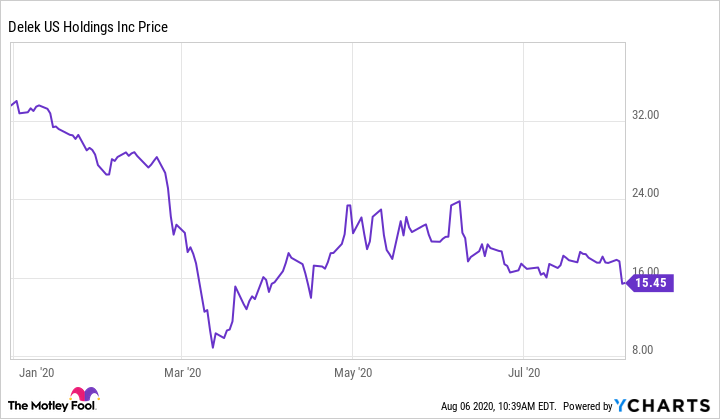

Danger Lurks For These 3 High Yield Dividend Stocks The Motley Fool

Oneok Inc Oke Stock 10 Year History

7 Dangerous Dividend Stocks To Sell Now Investorplace

Oke Oneok Inc Dividend History Dividend Channel

How Much Money Can I Earn By Investing In Dividend Income Tech Stocks By Marcus Tan Datadriveninvestor

Oneok Oke Dividends Dividend Yield Ex Dividend Date Dividend Payout Pay Date Dividend Dividend History

Oneok Stock Gather This 7 Yield While It S Cheap Nyse Oke Seeking Alpha

Oneok Named Top Dividend Stock With Insider Buying And 19 48 Yield Oke Nasdaq

How To Buy Oneok Stock Nyse Oke Stock Price 53 55 Finder Com

Load Up Says Jim Cramer About These 2 High Yield Dividend Stocks

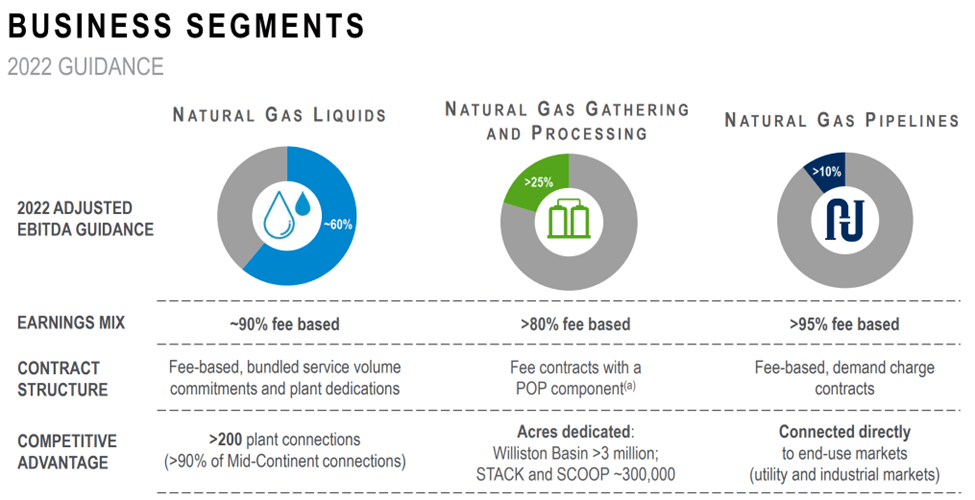

Description Of Securities Oneok Business Contracts Justia

Danger Lurks For These 3 High Yield Dividend Stocks The Motley Fool